If you are a level-headed American, aware of the financial chaos going on in our country today you’re probably already saving for retirement. You’ve been taking in your daily dose of Dave Ramsey, you’re reducing your debt, building that emergency fund, and investing in your 401K’s and IRA’s. The question is, are you following the number one rule for a winning portfolio?

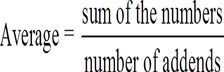

You see, back in junior high we were taught how to average numbers. As a practice run to jog your memory, average this list of numbers: -12, -24, 27, 9. If you recall, you add those number together and then divide the sum by 4(the number of figures to be added together). You should come up with 0 as your answer. Being a graduate of Finance from a high-ranking university I remembered this process quite well. What I didn’t notice during school was how much of a lie averages really are. I know they mentioned something about it in my statistics class but none of that really applied to me at the time. It does now! It applies to you too. Let me illustrate.

Let’s suppose the year is 2001 and you just inherited $10,000 from your grandmother. You put it into an investment account that followed the S&P 500 Index. Using those same numbers above(Those are that folks experienced during that time, according to the S&P500 Index. I rounded them a bit, to make this easy math, but those are real life numbers) after 4 years What is your average rate of return??? Zero! You got it! You’re a math genius!

The more important question now… How much money do you have in your account??? $9,258. You averaged 0% and still managed to lose $742, or almost 7.5%. You may be a math genius, but in this hypothetical example, your investment skills need some work!. Just kidding J

Losses kill your portfolio! no matter how diligent you are in your saving, budgeting, and paying off of debt, you can’t afford losses and expect to get ahead. This illustrates why Warren Buffet’s number one rule of investing is “Never Lose Money!” This should be your number one money rule too; NEVER LOSE MONEY.

If you are breaking this rule of investing, please stop now. If you’d like to learn how, email us at info@life1010.info and find out how millions of people are saying “no” to investment losses and saving for retirement with certainty and without market risk.

About this Author: Ed Kinsey has been in the financial services industry since 2003. He has experience in Real Estate, Mortgages, Commercial Finance, Annuities, and Life and Health Insurance. His goal is to benefit the lives of one million people. He want companies to start providing better benefits at lower costs through our services. He wants to enlighten people to the retirement benefits available through life insurance, the only tax free retirement option. We have secure solutions. Ed is also a world ranked powerlifter and fitness enthusiast.

About this Author: Ed Kinsey has been in the financial services industry since 2003. He has experience in Real Estate, Mortgages, Commercial Finance, Annuities, and Life and Health Insurance. His goal is to benefit the lives of one million people. He want companies to start providing better benefits at lower costs through our services. He wants to enlighten people to the retirement benefits available through life insurance, the only tax free retirement option. We have secure solutions. Ed is also a world ranked powerlifter and fitness enthusiast.

RSS Feed

RSS Feed